Private Equity

Private equity is the world's highest-performing asset class, and with Moonshot, you finally get access to it.

Venture Capital

Access groundbreaking innovations to the most sought-after startups shaping our future.

Tech-Enabled

Real Estate

Today, traditional real estate yields minimal returns. Our focus is on high-return, operational and tech-enabled properties.

Fixed Income

Earn a steady monthly income with private credit issued by reliable companies with a long-lasting track record.

Tangibles &

Collectibles

Invest in blue-chip art, rare watches, classic cars, and more to maintain and grow your capital.

Networking

Today, everything happens within networks. Form game-changing connections within a global community of accredited investors.

Knowledge

Access independent research, insights, and know-how from experienced investors within our network.

Privileges

Get services and benefits you would expect from first-class private banks or family offices.

Invest in blue-chip private equity and venture deals before the general public has access.

Infinity

The first all-in-one access to private markets on a monthly subscription. A versatile, multi-stage rocket for diversified alternative investing.

Meet, connect and relax in good company and exceptional comfort.

The sense of union

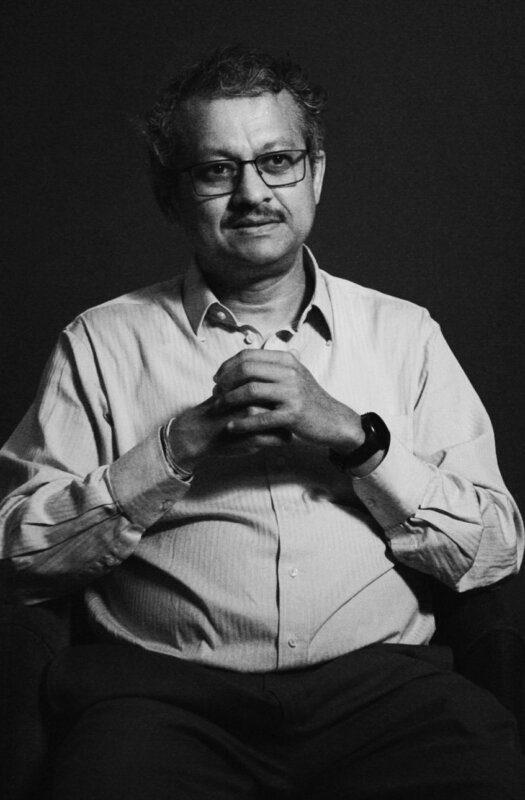

A conversation with Gopi Kallayil, Chief Business Strategist AI at Google, about "The happy human."

Lift-off & networking event

Learn how we democratize the world's most lucrative asset class and network among our community of accredited investors.

Living a better life

Judy Okten, Co-Founder and CEO of Burgeon Labs, about maximizing your energy for longevity.

Prof. Dr. Robert Riener, ETH Zurich

A conversation about the state of robotics with a highly cited scientist specializing in rehabilitation robotics, sensory-motor systems, and neurorehabilitation.

Our subscription model is out

Access private markets with our unique investment subscription, starting from small monthly payments.

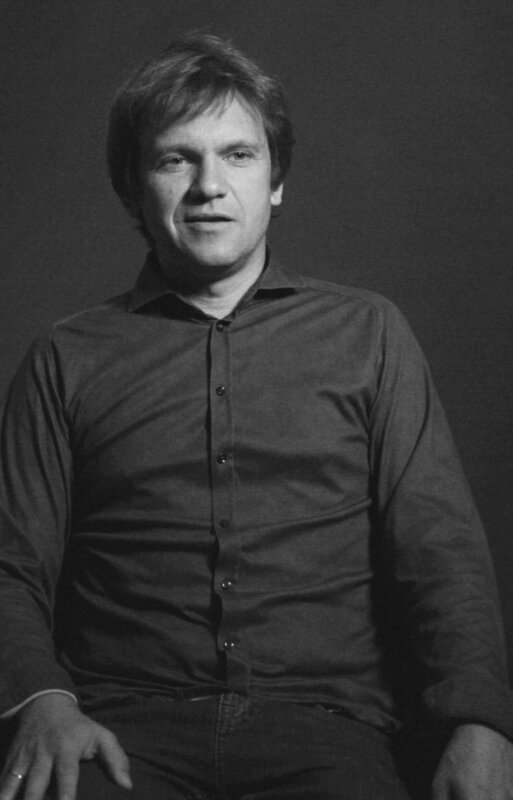

Lucas Ereth, Managing Partner at GenTwo

How pioneers are banking on a 78 trillion dollar investment opportunity.

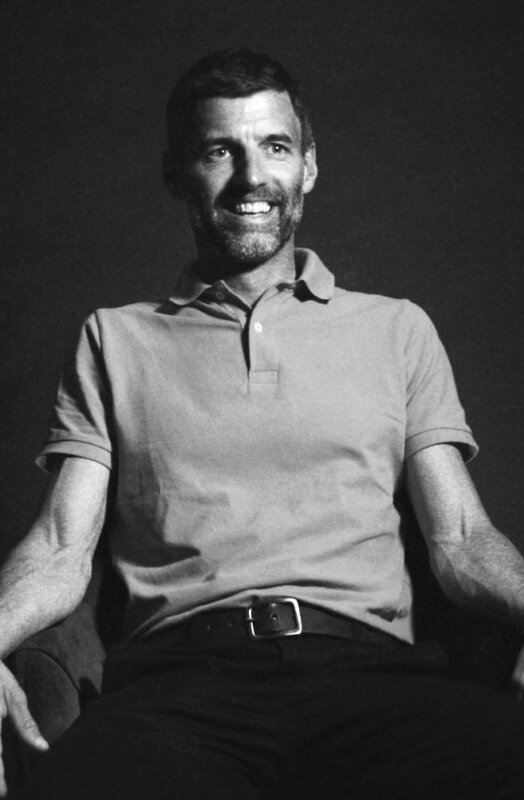

Prof. Dr. Michael Trübestein

A discussion about the current trends and challenges in real estate investing with a highly recognized expert.

Past: Davos 2025

Past: Lift-off and networking event

Past: Lift-off and networking event

Past: Lift-off and networking event

Past: Lift-off and networking event

Past: Lift-off and networking event - Fully Booked

Where diverse minds gather, great ideas bloom. Moonshot Circle is an expression of this, a salon for creators and explorers.

The only legacy that matters is inspiring others to do great things.

S&P 500 vs Private Equity¹

The highest risk-adjusted returns are in private markets. Private equity, for example, has significantly outperformed public markets for over 20 years. Adding private equity to your portfolio can enhance returns while minimizing risk.

1. The chart shows the net growth of a USD 1 hypothetical initial investment in the referenced indices on January 1, 2000. Sources: Cambridge Associates LLC, Yahoo Finance; Click for details.

Learn from the collective intelligence of experienced investors and accomplished entrepreneurs.

Join Us

Together, we democratize elite assets like private equity, fixed income, private real estate, and tangible assets like blue-chip art, rare watches, or classic cars that otherwise would be inaccessible to individuals.

Newsletter

Find out first about our new developments & exclusive offers

Invite your network to discover our exclusive private market investments, such as Synhelion or SpaceX, and earn lucrative rewards. If you share Moonshot as a logged-in user, you automatically make 2% (and up to 5% with our ambassador program) on your referral's first investment.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

Functional Always active

Preferences

Statistics

Marketing

Disclaimer

This report including any corresponding information, services, statistics, products or opinions described or referenced therein (“Report”) is provided by HFWM AG (“HFWM”), a brokerage firm for financial instruments domiciled in Zug, Switzerland. This Report does not claim to be exhaustive and presents only specific characteristics of the financial instrument described. It is based on information and data provided by the issuer of the respective financial instrument. While HFWM (owner and operator of the Moonshot platform) has taken considerable care to ensure that the Report is accurate and up-to-date, no assurance or guarantee is given, either expressly or implied, that the Report is accurate, complete or up-to-date. Neither HFWM, any related company, its executive management, employees, or agents accept responsibility and cannot be held liable for any direct or indirect or consequential loss suffered by an investor or any other person as a result from the use of the Report. Furthermore, HFWM does not assume any warranty or guarantee of any kind, expressed, statutory, or implied, concerning the information contained in the Report, any part thereof, or any results obtained from there.

The financial instruments mentioned in this Report as well as this Report itself are addressed in principle at qualified investors within the meaning of Art. 10(3) and 3ter of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, CISA, and at professional or institutional clients within the meaning of Art. 4(3-5) or Art. 5(1) and (4) of the Swiss Federal Act on Financial Services of 15 June 2018, FinSA (“Qualified Investors”). Certain financial instruments mentioned in this Report which are not explicitly restricted to Qualified Investors are also addressed to persons in Switzerland that do not meet the definition of Qualified Investor under the CISA or the FinSA (“Non-Qualified Investors”). If the financial instruments are directed exclusively at Qualified Investors, access to the relevant Report and any related information, services, opinions described or referenced therein, is restricted to Qualified Investors.

Certain financial instruments may qualify as structured products under the FinSA. As such, structured products do not constitute shares in collective investment schemes within the meaning of CISA and are, therefore, not subject to authorization and supervision by the FINMA. None of the information provided in this Report should be construed as an offer in Switzerland for the purchase or sale of financial instruments or any related services, nor as advertising pursuant to Art. 68 FinSA in Switzerland for financial instruments or any related services. This Report does not constitute a prospectus pursuant to Art. 35 et seqq. of the FinSA and may not fulfill the information standards required thereunder. This Report does not constitute investment, legal or tax advice.

The information provided in the Report has been prepared without regard to the objectives, financial situation, personal circumstances, or needs of any particular investor. The valuation of financial instruments may have been performed on a fair value or market price basis (e.g., based on the current sales price of the same securities). Please note that the above-mentioned financial instruments might be subject to lock-up periods. HFWM neither provides any liquidity for the sale of financial instruments nor guarantees that the current valuation of financial instruments can be realized in the event of a sale. The guidance for reporting financial instruments and their performance to tax authorities can solely be used as an indication, and HFWM does not take any liability for its accuracy.

Please consult with your tax expert or consultant to correctly declare financial instruments and potential earnings such as dividends, capital gains, or interests received.

By accessing the website of “Moonshot” (owned and operated by HFWM AG, Switzerland, with company number CHE 279.251.514 AG) or any affiliated company mentioned on its website (the “Website”), you confirm that you have understood and agreed with the terms of use and the conditions of the Website. If you do not agree with the terms and conditions, you must not access the Website.

The content of this website is advertising for financial instruments. This website uses cookies to ensure you get the best experience on our website.

By accessing this Website you furthermore confirm that you are a resident of Switzerland and a professional-client in the sense of articles 4 para. 3 to 5 or article 5 para. 1 and 4 of the Financial Services Act (FinSA).

None of the financial instruments referred to on the Website will be made available, nor will the corresponding term sheets, prospectuses, or other information documentation, as the case may be, be distributed to persons residing in any country, state, or jurisdiction where the marketing of such financial instruments would be contradictory to local law or regulation. Persons to whom such restrictions apply must not access the Website. Website users are responsible themselves for ensuring that they are legally entitled to access the Website. None of the financial instruments referred to on the Website is or will be registered in the United States of America under the 1933 Securities Act, as amended. Therefore, none of them is intended to be offered, either directly or indirectly, in the United States of America (including its territories and colonies), to nationals and persons domiciled in the United States of America, to persons normally domiciled in the United States of America or to persons for the benefit of or in favour of US nationals (as defined in Regulation S of the 1933 Securities Act). Persons to whom such restrictions apply must not access the Website.

The information provided on our website constitutes advertisement for financial instruments in the sense of article 68 FinSA. It is for information purposes only and does neither constitute investment advice, a solicitation, or a recommendation to buy or sell any financial instruments, nor does it constitute recommendations or guidance for decisions concerning any investments and is not a result of objective or independent research. The Website's content does not claim to be exhaustive and presents only certain characteristics of the instrument described. It is based on information and data provided by the issuer of the respective financial instrument. Although reasonable efforts have been performed by HFWM AG to ensure that the information contained on the Website is up to date and accurate, and despite HFWM AG is as diligent as possible in compiling and updating the information on the Website, it has not verified and cannot guarantee the accuracy and completeness of the information presented on the Website and HFWM AG does not assume any warranty or guarantee of any kind, expressed, statutory, or implied, with regard to the information contained on the Website, any part thereof, or any results obtained therefrom. The information provided on the Website has been prepared without regard to the objectives, financial situation, personal circumstances, or needs of any particular investor. Whilst interested investors are strongly encouraged to carefully review all relevant investment information provided on the Website, interested investors should in any case consult with their own financial and tax advisor regarding the risks and rewards of any financial instrument presented on the Website before making any investment decision.

Users may leave the Website by clicking on a link. Visiting these external websites shall be done exclusively at users’ own risk. Moonshot (HFWM AG) has not verified the content or security of external websites accessible through links on its own Website and does not assume any responsibility for the information they contain, particularly not for any offers, information, or opinions. Moonshot (HFWM AG) does not assume any responsibility for any damage caused during visits to such external websites. Users may visit external websites under their own responsibility and at their own risk.

Moonshot (HFWM AG) shall not be liable for losses resulting from email messages that are received late or not at all. This also applies to other unprotected forms of communication whose function and risk exposure is similar to that of email messages.

Past performance is no guarantee for future returns. In particular, there is no guarantee that an investor’s capital will be protected or that the value of employed capital or of shares will be equal to or greater than an investor’s original investment when the investor sells his shares or withdraws his capital.

HFWM AG and its contractual partners decline any liability (including negligence and third-party liability) for any direct, indirect, or consequential loss or damage arising from reliance on this Website, in connection with the information, performance data, and other statements, links, or other communications contained on the Website or related to the risks of the financial instruments presented on the Website or the risks of financial markets.

The Cambridge Associates LLC US Private Equity Index (CA PE) is a pooled horizon IRR calculation based on quarterly data compiled from 1,496 US private equity funds, including fully liquidated partnerships, formed between 1986 and 2022.

The S&P 500 TR Index calculates both the price movement of the S&P 500 and the dividends that the stocks within the S&P 500 paid.

The methodology behind the calculations focused on establishing parity in the measurement frequency of both indices to a quarterly basis. This adjustment was made due to the fact that investment-level performance information of private equity funds behind the CA PE Index is drawn from the fund managers' quarterly and annual financial statements.

The chart is made for illustrative purposes only, as neither the Cambridge Associates LLC US Private Equity Index nor the S&P 500 Total Return Index can be directly invested in. These indexes are simply measures of the performance of their constituent securities.

Please complete the onboarding call to start investing.