By accessing the website of “Moonshot” (owned and operated by HFWM AG, Switzerland, with company number CHE 279.251.514 AG) or any affiliated company mentioned on its website (the “Website”), you confirm that you have understood and agreed with the terms of use and the conditions of the Website. If you do not agree with the terms and conditions, you must not access the Website.

The content of this website is advertising for financial instruments. This website uses cookies to ensure you get the best experience on our website.

By accessing this Website you furthermore confirm that you are a resident of Switzerland and a professional-client in the sense of articles 4 para. 3 to 5 or article 5 para. 1 and 4 of the Financial Services Act (FinSA).

None of the financial instruments referred to on the Website will be made available, nor will the corresponding term sheets, prospectuses, or other information documentation, as the case may be, be distributed to persons residing in any country, state, or jurisdiction where the marketing of such financial instruments would be contradictory to local law or regulation. Persons to whom such restrictions apply must not access the Website. Website users are responsible themselves for ensuring that they are legally entitled to access the Website. None of the financial instruments referred to on the Website is or will be registered in the United States of America under the 1933 Securities Act, as amended. Therefore, none of them is intended to be offered, either directly or indirectly, in the United States of America (including its territories and colonies), to nationals and persons domiciled in the United States of America, to persons normally domiciled in the United States of America or to persons for the benefit of or in favour of US nationals (as defined in Regulation S of the 1933 Securities Act). Persons to whom such restrictions apply must not access the Website.

The information provided on our website constitutes advertisement for financial instruments in the sense of article 68 FinSA. It is for information purposes only and does neither constitute investment advice, a solicitation, or a recommendation to buy or sell any financial instruments, nor does it constitute recommendations or guidance for decisions concerning any investments and is not a result of objective or independent research. The Website's content does not claim to be exhaustive and presents only certain characteristics of the instrument described. It is based on information and data provided by the issuer of the respective financial instrument. Although reasonable efforts have been performed by HFWM AG to ensure that the information contained on the Website is up to date and accurate, and despite HFWM AG is as diligent as possible in compiling and updating the information on the Website, it has not verified and cannot guarantee the accuracy and completeness of the information presented on the Website and HFWM AG does not assume any warranty or guarantee of any kind, expressed, statutory, or implied, with regard to the information contained on the Website, any part thereof, or any results obtained therefrom. The information provided on the Website has been prepared without regard to the objectives, financial situation, personal circumstances, or needs of any particular investor. Whilst interested investors are strongly encouraged to carefully review all relevant investment information provided on the Website, interested investors should in any case consult with their own financial and tax advisor regarding the risks and rewards of any financial instrument presented on the Website before making any investment decision.

Users may leave the Website by clicking on a link. Visiting these external websites shall be done exclusively at users’ own risk. Moonshot (HFWM AG) has not verified the content or security of external websites accessible through links on its own Website and does not assume any responsibility for the information they contain, particularly not for any offers, information, or opinions. Moonshot (HFWM AG) does not assume any responsibility for any damage caused during visits to such external websites. Users may visit external websites under their own responsibility and at their own risk.

Moonshot (HFWM AG) shall not be liable for losses resulting from email messages that are received late or not at all. This also applies to other unprotected forms of communication whose function and risk exposure is similar to that of email messages.

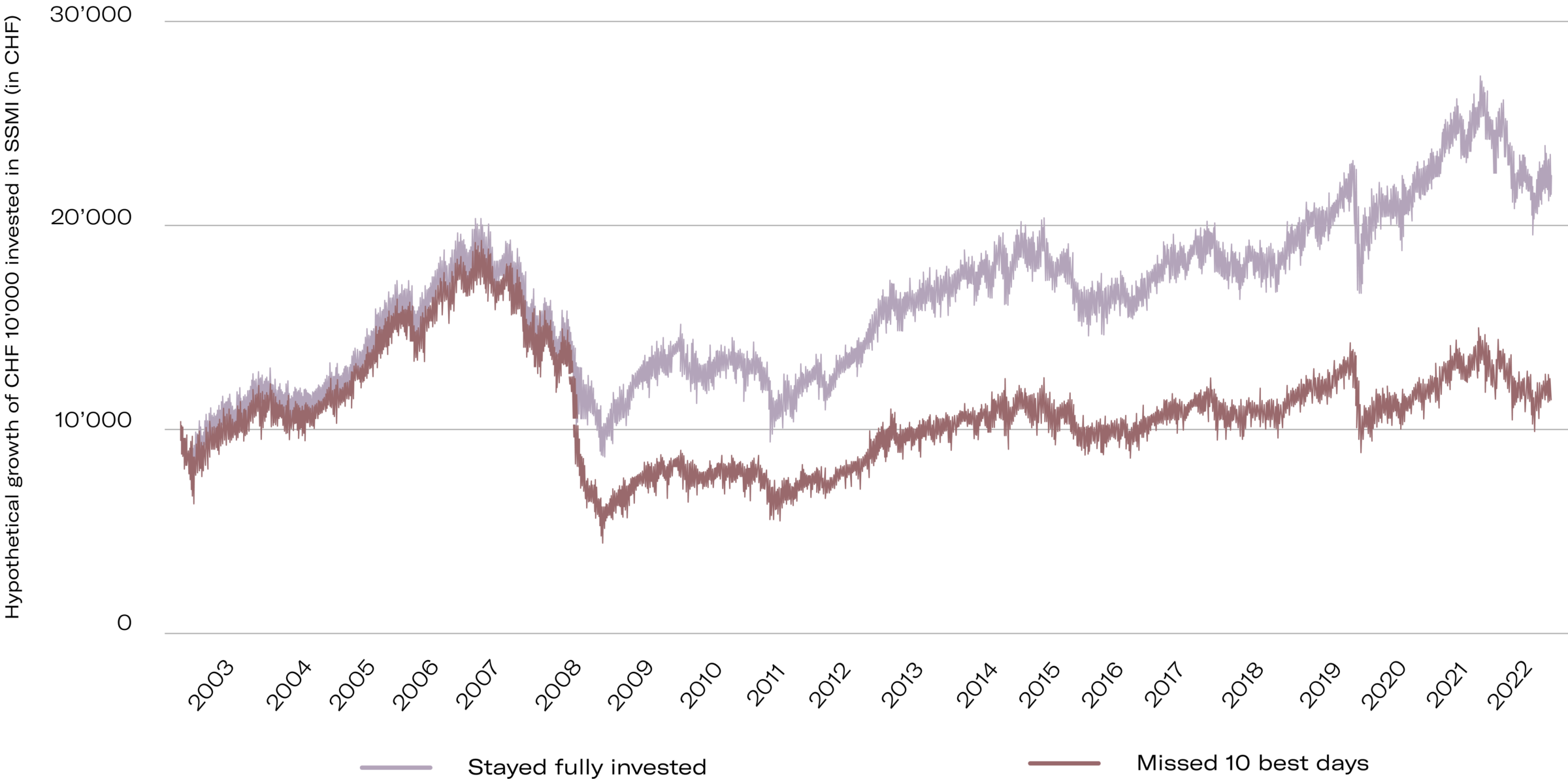

Past performance is no guarantee for future returns. In particular, there is no guarantee that an investor’s capital will be protected or that the value of employed capital or of shares will be equal to or greater than an investor’s original investment when the investor sells his shares or withdraws his capital.

HFWM AG and its contractual partners decline any liability (including negligence and third-party liability) for any direct, indirect, or consequential loss or damage arising from reliance on this Website, in connection with the information, performance data, and other statements, links, or other communications contained on the Website or related to the risks of the financial instruments presented on the Website or the risks of financial markets.