Swiss private real estate development

Amēa Lago Maggiore

Together with the world-renown architects, the newly established Swiss luxury real estate brand Amēa is developing modern luxury villas for holiday stays and exclusive events, nestled in the world’s most breathtaking locations.

Timesharing reinvented.

Enjoy the benefits of a glamorous villa in some of the most scenic holiday destinations in the world while lucrative returns starting from CHF 25’000.

The post-pandemic world will be local. Benefit from a customer base with one of the highest purchasing powers in the world – The Swiss. Amēa was born and raised in Switzerland but addressed the world.

7.14-16.05%

Yearly return during the development phase - depending on chosen equity model

up to 2.33x

High multiple during the development phase

Infinite

Target Investment Hold Period approx 4-5 years or infinite

Why we're investing

Real Estate has always been a cornerstone of wealth generation and preservation. Properties in Ultra-Prime locations maintain a stable value during almost every economic situation.

However, quality opportunities are challenging to source, operationally intensive, and often burdened by high prices, misalignment, or poor performance.

Amēa merges this highly secure asset class with high-performing operational business models. For investors seeking long-term investment, Amēa offers a second layer of cost-free self-use (Timesharing), making it the perfect investment case for private investors.

Development

Lucrative financing concept during development, offering up to 16.05% annual returns

Location

The most prestigious and sought after location in the southern part of Switzerland

Switzerland

Prime location in one of the most stable countries on earth

Milestones & Roadmap

Introduced to public

Feasibility study Successful

Securitisation of plot

BUILDING PERMISSION

START OF DEVELOPMENT PHASE

DEVELOPMENT PHASE

OPENING DOORS

The investment opportunity

Invest in Amēa Lago Maggiore

We are investing at the current investment round of CHF 66M and estimate a 2.33x multiple within ten years. This represents an annualized return of around 16.05% per year.

The equity investment is made via a share company. The fixed-income investment (bond) will be asset-backed once available.

up to 2.33x

up to 16.05% p.a.

* This offer is accessible for professional and non-professional investors and is an advertisement for financial instruments. The historical performance of any strategy or portfolio is no guarantee of the current and future performance. The value of the portfolio may rise or fall at any time. In general, we advise you to seek advice from a tax and investment professional prior to investing. The published information does not constitute a solicitation, an offer, or a recommendation.

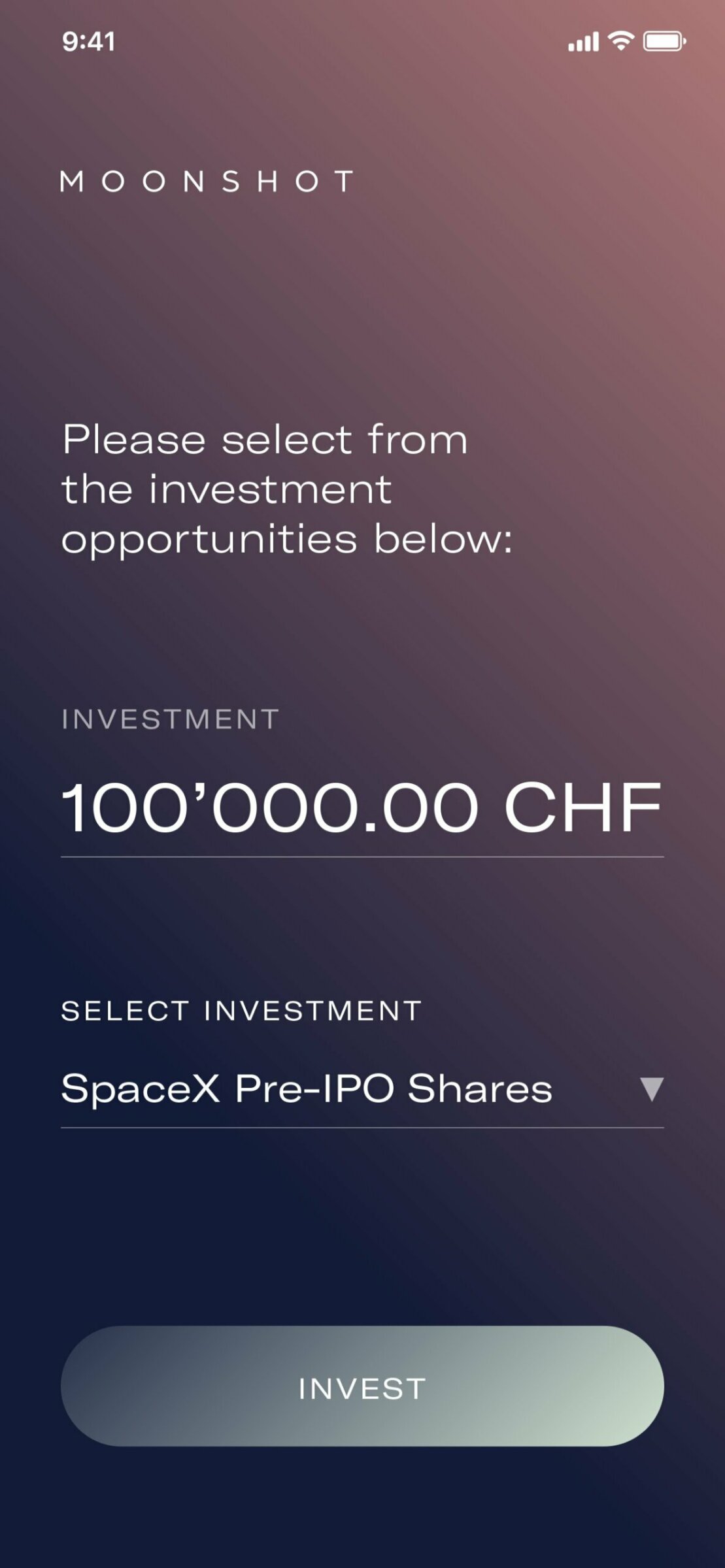

Projected Returns Calculator

Shares vs. Bonds

What's the difference between bonds (fixed income) and shares (equity)?

| Instrument: | Equity (Shares) | Fixed income (Bond) |

| Return p.a.: | Up to 16.05% p.a. | 2,23% - 8,12 p.a., fixed interest, depending on duration and securitisation |

| Interest payment: | n/a | Monthly |

| Minimum hold | 5 years | 4 or 7 years, repayment on majurity |

| Min. Investment | CHF 25'000 | CHF 25'000 |

| Investor focus | Longterm | Fixed maturity (4 or 7 year term) |

| Securitization: | Certificate/Shares | Mortgage backed depending on issue |

| Withholding tax: | No | 35% |

| Income tax | Only on amounts exceeding KER | Yes |

Why Private Real Estate?

Real estate is the most important pillar for multigenerational wealth creation.

Non-correlated

The performance of real estate is not closely correlated with stocks, bonds, or REITs.

Capital Preservation

Real estate, when properly aligned and managed, is a hard asset that preserves capital.

Cash Flow

Real estate generates stable and predictable cash flow.

Target Returns as a % of Initial Equity-Investment during Development Phase

Hypothetical Investment (10y)

CHF 1,000,000

Total Returned

CHF 2,330,000

Performance

Financials are published every quarter, semester, or year (as applicable). If available, Moonshot reviews and analyzes financials for its members.

Liquidity

We can quickly find a new buyer for your shares, should you require unexpected liquidity. Moonshot acts as a "match-maker" via the in-house "Bulletin Board”.

Insights

Know what’s going on before everyone else does. We keep you posted, as much as you like.

Our investment process

Investment-related questions?

Schedule a call and ask us anything.

Ready to invest?

Go through the easy online process or schedule a call with us to help you.