Invest in all our vetted private debt deals at once.

Moonshot enables you to invest in selected private debt deals on a deal-by-deal basis. The Fixed Income Strategy now enables you to invest in all of the private debt deals you see (or saw) on our platform with one product. Please note that structured products are not subject to FINMA supervision and that the deposit guarantee does not cover these investments.

4.20%

annual interest paid out monthly

Monthly

Receive monthly payouts to your account

90 days

Withdrawals within three months' notice

Facts & Figures

The investment objective of this strategy is to create a fixed, risk-adjusted return of 4.20% p.a.

We regularly rebalance the portfolio and distribute the proceeds equally among the offered bonds according to the asset allocation target as displayed above. The allocation target may vary depending on asset availability.

Liquidity position: The portfolio holds cash or liquid asset position to enable early redemptions described further down on this page. Please note that structured products are not subject to FINMA supervision and that the deposit guarantee does not cover these investments.

| Instrument: | Actively Managed Certificate (AMC) |

| Fixed return: | 4.20% p.a. |

| Profit distribution: | Monthly |

| Minimum term: | 3 months |

| Term: | Perpetual |

| Repayment: | Termination and repayment after 3 months (free of charge) of up to CHF 25'000 per month |

| Administration fee: | 0.25% p.a. (charged by issuer and already deducted from performance) |

| Setup fee: | No |

| Performance fee: | No |

| Withdrawal limit: | CHF 25'000 per month |

| Min. investment: | CHF 10'000 |

Unique benefits

We only invest in private debt which is not listed on any public market. Therefore the investment is not volatile and offers a stable interest of 4.20% p.a.

Our bond investments are issued from Swiss companies and have shown reliable track-record over many years. Switzerland is one of the most stable economies in the world.

Our Fixed Income Strategy pays a monthly interest of 4.20% per annum.

You can top-up your investment at any point in time due to the low minimum investment of only CHF 10'000.

Projected Returns Calculator

The Investment Structure:

Actively Managed Certificate (AMC)

"Actively Managed Certificates" ("AMC") are structured products whose underlying asset is managed on a discretionary basis during the term of the product in accordance with a specific investment strategy.

The average ticket size in private market investments is often exceeding CHF 5M. Moonshot uses actively managed certificates (structured product) issued by its issuance company "MISP AG" to split the investment size into smaller tickets to make them accessible to private investors.

Our investment process

Investment-related questions?

Schedule a call and ask us anything.

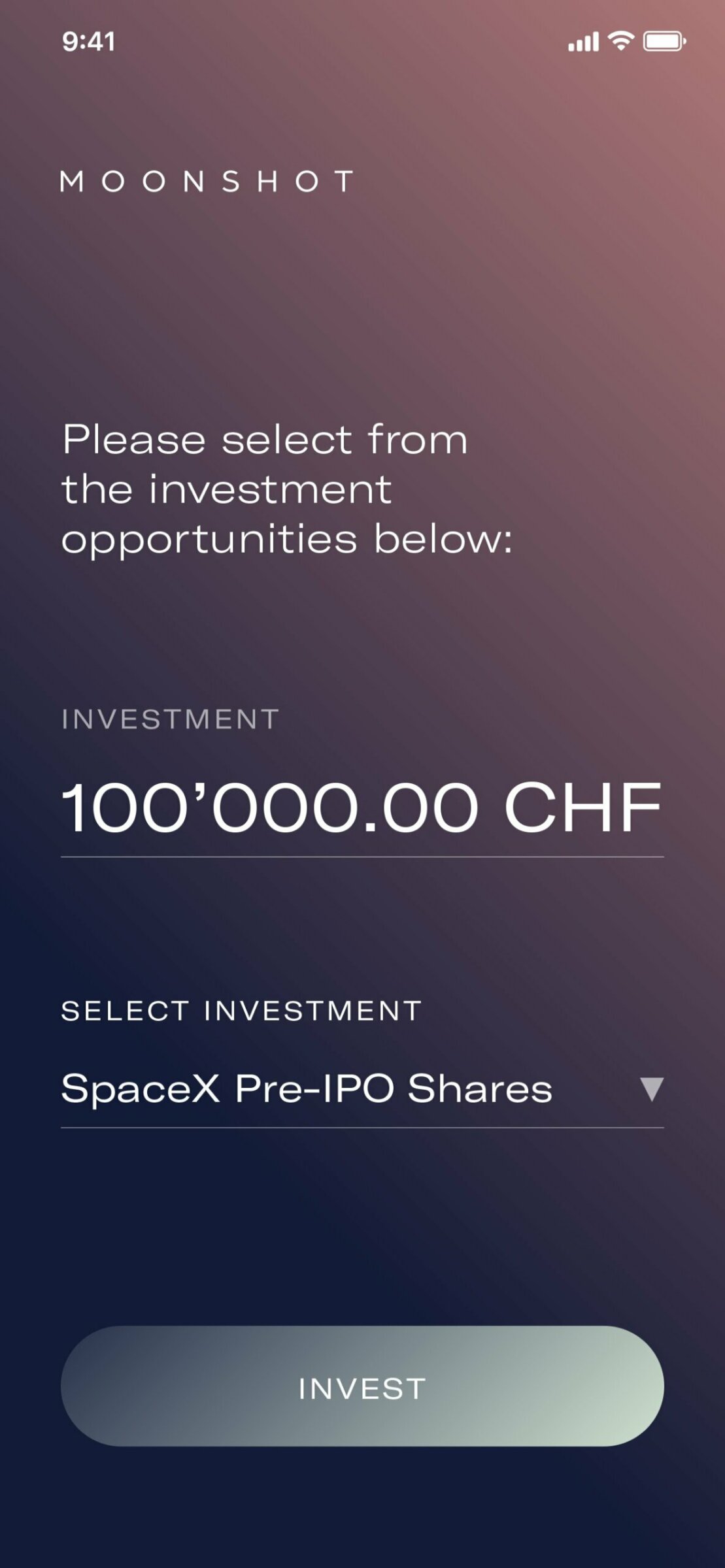

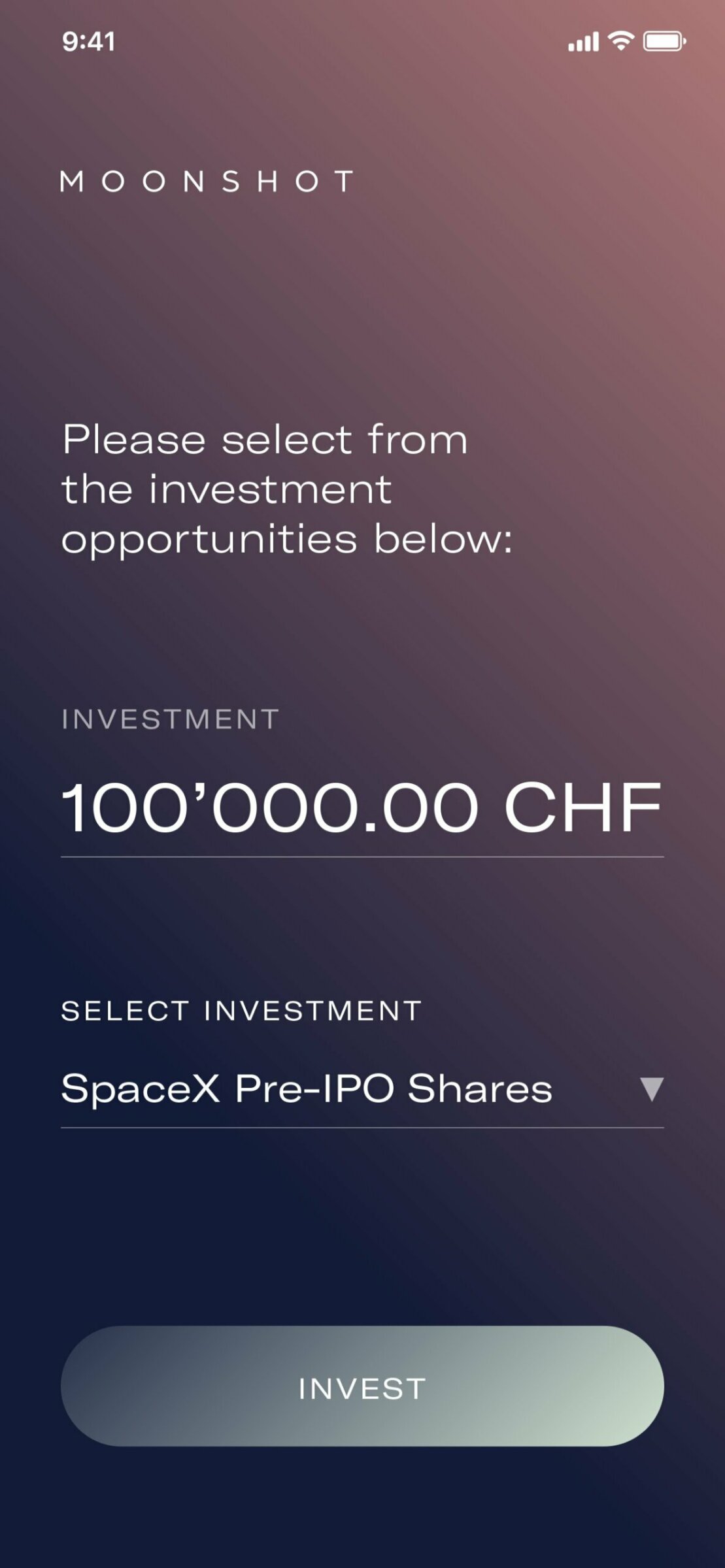

Ready to invest?

Go through the easy online process or schedule a call with us to help you.