1.8-2.4x

Target Net Money Multiple

2%

Mnagement Fee

5-7 years

Target Investment Hold Period 5-7 years

Facts & Figures

The investment objective of this strategy is to invest in private equity funds to create a lucrative and steady return.

We regularly rebalance the portfolio and distribute the proceeds equally among all the offered projects according to the (approximative) asset allocation target as displayed above. The allocation target may vary depending on asset availability.

Liquidity position: The portfolio holds a 7% cash or liquid asset position to enable early redemptions described further down on this page.

| Instrument: | Actively Managed Certificate (AMC) |

| Expected return (based on historic asset results): | 1.8-2.4x MOIC |

| Profit distribution: | Profits are reinvested (compounding) |

| Lockup period: | 5 years after initial investment, early redemption after 1st year |

| Administration fee: | 2% p.a. (charged by issuer) |

| Setup fee: | 1.25% |

| Performance fee: | 20% |

| Exit (Liquidity-Window): | From 1-31 July each year (after lockup), investors can exit via pull option |

| Fire sale redemption fee: | 30% until lockup, 5th year and onwards = no fee |

| Secondary transactions: | Yes, after lockup period 8.5% replacement fee |

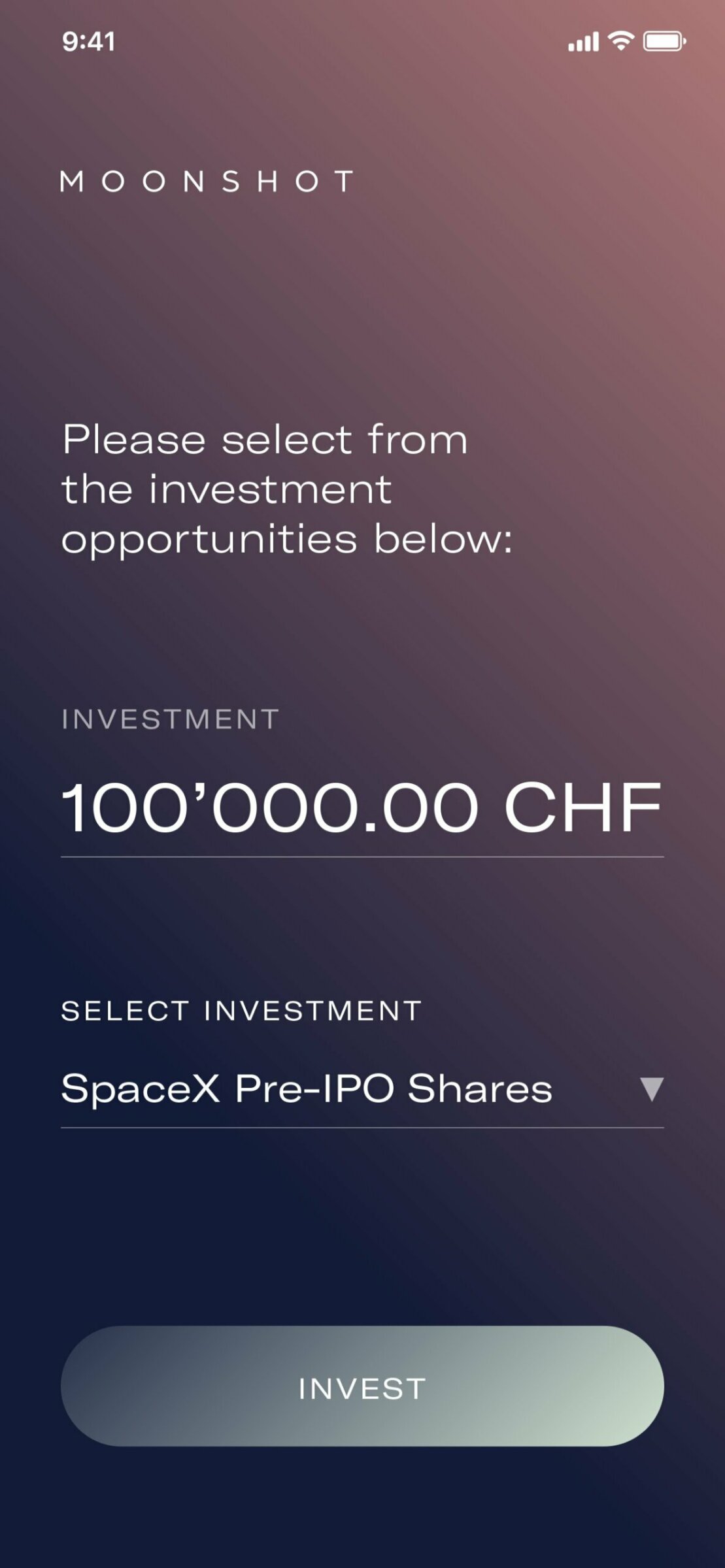

| Min. investment: | CHF 10'000 |

| Investment horizon: | 5-7 years |

Here is what sets THIS STRATEGY apart and ahead.

Benefit from what institutional investors already know: the greatest investor value comes from private markets.

Most value is being captured during the time companies are private. Because of that, private assets have outperformed their public counterpart for over two decades. This has happened through all economic cycles.

High return

In this strategy, we are focusing on private equity funds. Our target funds have outperformed public markets by far and generated steady returns.

Diversification

Moonshot enables you to invest deal by deal or with us in the driver's seat, allocating your money smartly to our vetted opportunities. Because of this, investors enjoy more stable returns while minimizing their risk.

Hard to find

Finding private equity opportunities is not easy. Our network enables us to access some of the most lucrative ones and offer them to our members. Our track record, therefore, is our best value proposition.

Unique Tax Benefits

This investment is NOT subject to the 35% withholding tax.

For private investors (individuals) with tax residence in Switzerland, the AMCs are treated like a unit of a collective investment scheme. The Issuer informs the Swiss Federal Tax Administration about the capital gains/losses, and the earnings on the assets on an annual basis. Only the declared net earnings on these assets are subject to income tax. Gains and losses realized on the Strategy Value as well as gains and losses derived from the sale of the AMC should be considered as income tax-free private capital gains and non-tax-deductible private capital losses, respectively.

There is no Swiss stamp duty upon issuance of the AMCs. Secondary market transactions are subject to Swiss stamp duty of up to 0,15%. There is no Swiss stamp duty upon redemption of the AMCs.

If not otherwise agreed with the investor, our AMCs are non bankable and therefore do not require a securities deposit account.

The Investment Structure:

Actively Managed Certificate (AMC)

"Actively Managed Certificates" ("AMC") are structured products whose underlying asset is managed on a discretionary basis during the term of the product in accordance with a specific investment strategy.

The average ticket size in private equity investments is often exceeding CHF 5M. Moonshot uses actively managed certificates (structured product), issued by its own issuance company "MISP AG" to split the investment size into more minor tickets to make them accessible for private investors.

Target Returns as a % of Initial Investment

Hypothetical Investment

CHF 250,000

Total Returned

CHF 570,000

What if you require unexpected liquidity?

Early redemptions & Liquidity

Most private investments typically target a 10-15-year hold, but with Moonshot, you have the potential to exit earlier.

Performance

Financials are published every quarter, semester, or year (as applicable). If available, Moonshot reviews and analyzes financials for its members.

Liquidity

We can quickly find a new buyer for your shares, should you require unexpected liquidity. Moonshot acts as a "match-maker" via the in-house "Bulletin Board”.

Insights

Know what’s going on before everyone else does. We keep you posted, as much as you like.

Liquidity-Window

During July (1st till 31st) of every year after the minimum holding period of 5 years, investors have the opportunity to exit their investment and withdrawal their funds. 7% (up to 10%) of the total AUM (assets under management) within the basket will be allocated to cash or liquid assets.

In case of a termination, the 7% liquidity reserves will be used to proportionally buy back certificates from investors. If the reserves are not sufficient to satisfy all terminations, they will be allocated pro-rata to every investor having declared the withdrawal.

As the strategy requires a 5-year minimum term, free redemptions are only possible after the holding period. Should the 7% liquidity reserves not be sufficient to cover all withdrawal requests, investors can still mandate Moonshot's secondary market for the reselling of their certificates (subject to fees).

Bulletin Board (Secondary Transactions)

Moonshot acts as a “match-maker” via the in-house “Bulletin Board” should an investor require early liquidity. The auto-adjusted return will be added to your securities (shares/bonds/certificates) as a default base-price finding for placing the securities in our investor network of over 7’000 active investors.

Please note, liquidity is not provided or guaranteed by Moonshot. Secondary offerings are only supported once Moonshot's primary offering has been closed.

Our investment process

Investment-related questions?

Schedule a call and ask us anything.

Ready to invest?

Go through the easy online process or schedule a call with us to help you.